Who is this course for?

The course is suitable for anyone who is interested in venture capital, including entrepreneurs, enthusiast in the start up and innovation space, portfolio managers, policy makers or regulators interested in finding out more about the venture capital landscape.

Course Highlights

Experience in-depth lectures featuring real-world case studies, interactive discussions and hands-on practice.

Tap on expertise of industry practitioners to explore the demands of venture capital

Ready yourself to grow, pitch and secure venture funding for your new and existing products

Earn NUS-AIDF certification with newly equipped skills

Course Details

Develop a confident pitch highlighting Minimum Viable Proposition and its related components

Craft a compelling value proposition demonstrating the benefits and differentiators of a product or service to the target customer base.

Identify the balance between founder-friendly and investor-friendly agreements.

Define the investment process and the 5Ps of investing.

Examine the venture capital and fundraising process in technological ventures in the areas of fintech like Artificial Intelligence and Blockchain

Differentiate types of investment instruments and deal terms

Course Fees

Course Fees (before SSG Funding): SGD 3,433.50

SkillsFuture Code: TGS-2024047734

This programme is eligible for subsidies under SkillsFuture Singapore (SSG). Singaporeans and Permanent Residents can enjoy subsidies up to 90%.

| Singapore Citizens & Permanent Residents aged 21 and above |

Singapore Citizens aged 40 years and above | International Participants | |

| Self-sponsored | SGD 1,030.05¹ | SGD 400.05² | SGD 3,433.50 |

| SME Company-sponsored | SGD 400.05² | SGD 400.05² | SGD 3,433.50 |

| Non-SME Company Sponsored | SGD 1,030.05¹ | SGD 400.05² | SGD 3,433.50 |

All fees stated above are net fees payable and include 9% GST. All Singaporeans aged 25 years old and above are eligible to claim their SkillsFuture Credits to further offset the net fees payable.

¹Up to 70% course fee funding

²Up to 90% course fee funding under MCES or ETSS

Course Outline

Course Instructors

Prof Edward Tay

Head of CET & Executive Education, NUS AIDF

An investor in four deep tech unicorns, driving innovation in Artificial Intelligence, Digital Economy and Green Tech and leadership roles in esteemed organizations like Sistema Asia Capital, British Telecom, IBM and Hewlett-Packard, Prof Edward's passion lies in navigating the complexities of Asian Technology Markets.

As an Associate Professor (Practice) at the United Nations Institute for Training and Research (UNITAR), he is serving concurrently as the Chair of the United Nations Sustainable Development Goals Research Lab, Council Member in Singapore Accreditation Council & Independent Board Member in Digilife Technologies Limited (Listed in Catalist, SGX), bridging the gap between academia and industry.

Mr Kau Yi Ming

Venture Partner, Krux Asia

Mr. Yi Ming is a Venture Partner at Krux Asia, bringing significant expertise in venture capital, technology, and business strategy. With a deep understanding of emerging markets in Asia, Mr. Yi Ming focuses on identifying and supporting high-growth startups in sectors such as technology, digital finance, and innovation-driven industries.

At Krux Asia, Mr. Yi Ming plays a pivotal role in shaping investment strategies, leveraging his broad network and deep industry knowledge to source and evaluate promising startups. His responsibilities also include providing strategic guidance to portfolio companies, helping them scale effectively and navigate complex market environments.

Mr. Yi Ming's background includes years of experience in venture capital and entrepreneurship, making him a valuable mentor and partner to the startups he supports. His strategic insights and hands-on approach contribute to the growth of Krux Asia’s portfolio, fostering innovation and driving the development of disruptive technologies across the region.

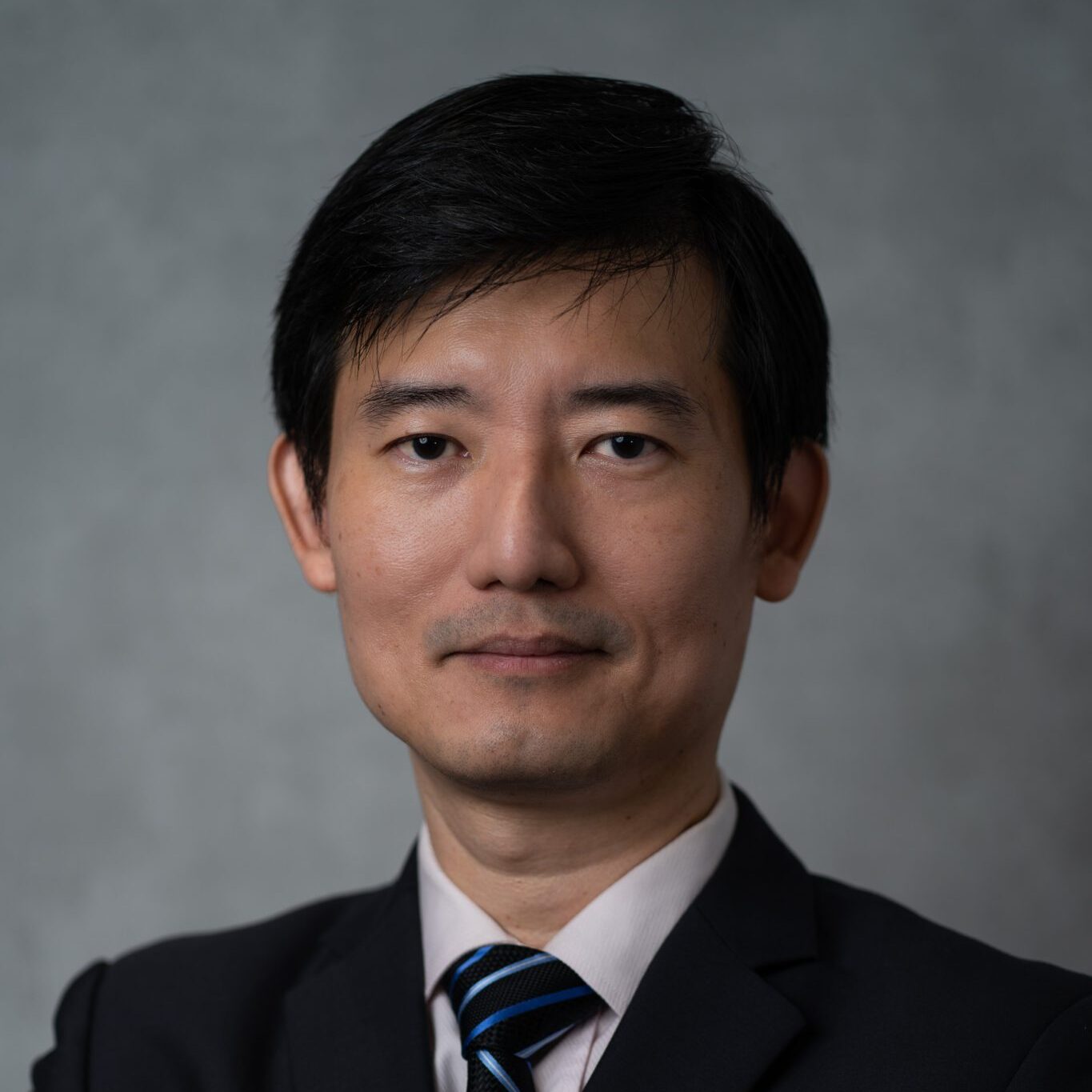

Dr Wilson Wang

Head, Postgrad and CET Programs, NUS Enterprise Academy

Dr. Wilson Wang serves as the Head of Post Graduate and Continuing Education and Training (CET) programs at NUS Enterprise Academy. With a focus on innovation and entrepreneurship, Dr. Wilson leads initiatives that equip professionals and graduates with the skills needed to excel in a rapidly changing business landscape.

Under his leadership, the Academy offers cutting-edge programs that bridge academic knowledge with real-world application, fostering a culture of innovation among learners. His work ensures that participants are well-prepared to navigate global trends and emerging technologies, making a meaningful impact in their respective fields.

Ms Shi Mei Chin

CFO, Spark Systems

Ms Shi Mei Chin is the Chief Financial Officer (CFO) at Spark Systems, a leading financial technology company specializing in foreign exchange trading solutions. As CFO,

Ms Shi Mei plays a critical role in managing the company's financial strategy, overseeing budgeting, financial planning, and risk management to ensure sustainable growth. Her expertise in finance and leadership ensures the company maintains its competitive edge in the FinTech space while navigating complex financial landscapes.

With a strong background in corporate finance and strategic planning, Ms Shi Mei contributes to Spark Systems' success in delivering cutting-edge trading technologies to global markets.