Organised by Optiver and the NUS Asian Institute of Digital Finance, Centre of Quantitative Finance and Department of Mathematics, the Algorithmic Trading Workshop is a two-day comprehensive course that delves into the world of financial markets and trading.

Led by Optiver industry experts Robbert Pullen, Dennis van de Werken and Adrian Dudek, the course takes you from the foundations of options theory to hands-on algorithm development and testing in Python. Through a blend of theoretical lectures, expert guidance and hands-on application, you’ll learn how to build high-performance Python trading algorithms and have the unique opportunity to test it in real-world trading scenarios.

As part of the two-day workshop, you’ll:

- Gain a deep understanding of financial markets, options theory and algorithmic trading – no financial background required!

- Develop the skill to design and optimise a Python trading algorithm based on real financial market data.

- Build a dual listing arbitrage trading strategy, spotting profitable risk-free trading opportunities through correctly interpreting the microstructure of the order books.

- Implement a fully automated options market making strategy, whilst considering important factors such as managing positional risks and adverse selection.

Plus, test your algorithm against your classmates in a friendly competition at the end of the course, for the chance to win an exciting prize!

Eligibility Criteria

- Studying a STEM degree

- Familiar with Python or proficient with other programming language

- Be able to commit to a two full day workshop from 9am- 5pm

Note that applicant information, whether submitted through CV or the provided Google form, will be collected by Optiver, and submission implies consent to this data collection.

Trainers

Adrian Dudek

PhD in Pure Maths

Options Trader

Head of Academic Partnerships APAC

Robbert Pullen

Chemistry at Leiden University

Trader

Trading trainer

Head of academic partnerships

Greg Saunders

PhD in Computer Science

Software Developer

Head of IT Education APAC

Dennis van de Werken

Econometrics at Erasmus university

Quantitative Finance alumni

Quantitative Researcher at Optiver

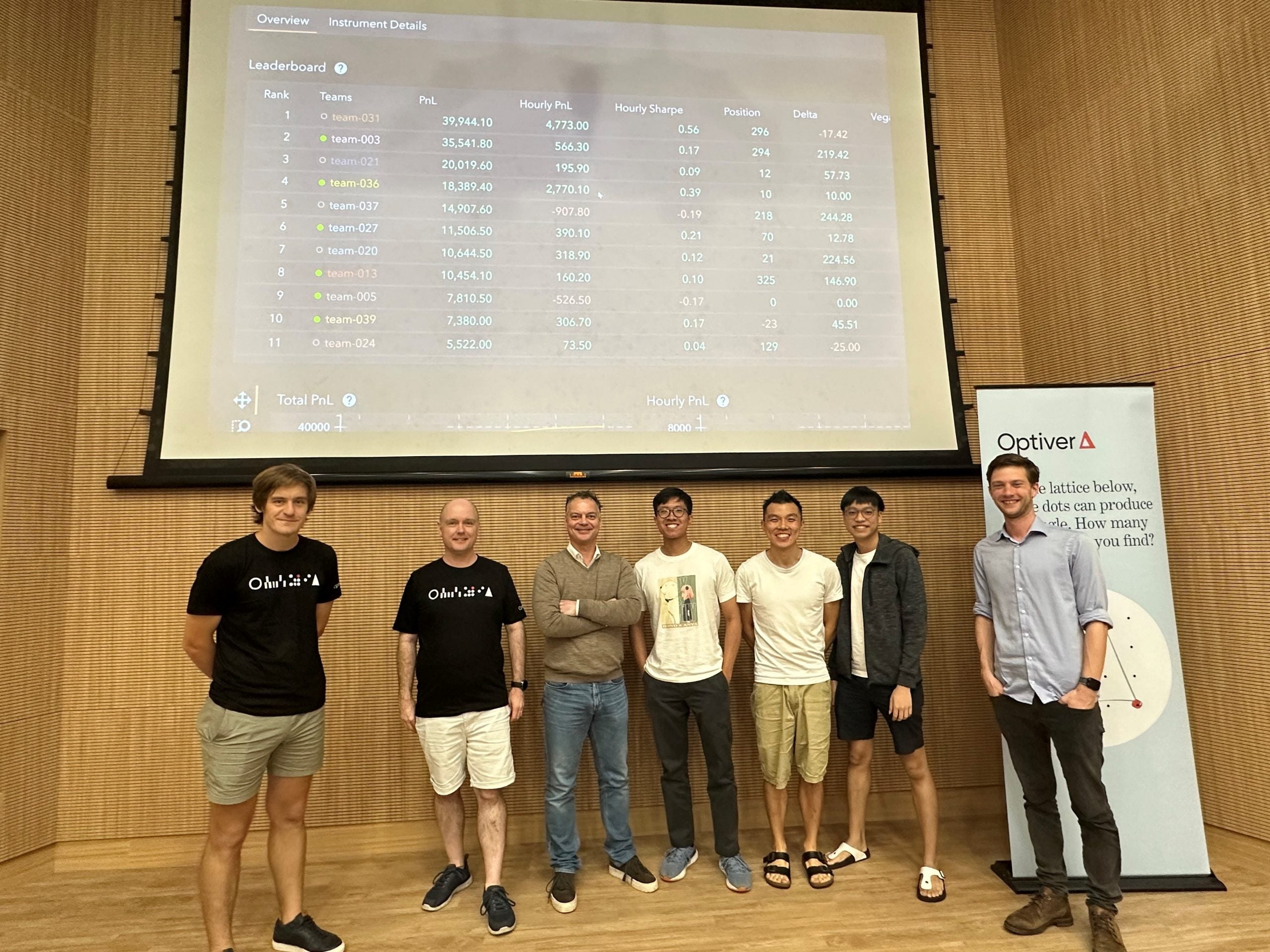

Winners:

First Place

Sean Keat Toh (BSc in Math Undergrad), Linus Lee (BComp in Computer Science Undergrad), and Peter Haw (Master of Computing).

Second Place

Peng Hanqiu (Math, PhD), Zhang Hongrui (Math, PhD),

and Tracy Zhou Lei (AIDF, RF).

About Optiver

Optiver is a global market maker with offices in Amsterdam, London, Chicago, Austin, Sydney, Shanghai, Hong Kong, Singapore and Taipei. Founded in 1986, today we are a leading liquidity provider, with close to 2,000 employees in offices around the world, united in our commitment to improve the market through competitive pricing, execution and risk management. By providing liquidity on multiple exchanges across the world in various financial instruments, we participate in the safeguarding of healthy and efficient markets. We provide liquidity to financial markets using our own capital, at our own risk, trading a wide range of products: listed derivatives, cash equities, ETFs, bonds and foreign currencies.

Organised by:

If you have any further questions, please get in touch with the Optiver team at singaporecareers@optiver.com.au