UNLOCKING NEW POSSIBILITIES WITH GENERATIVE AI IN FINANCE

This course aims to provide an overview of Artificial Intelligence (AI) with the focus on Generative AI and its applications in finance. According to a March 2024 report by the McKinsey Global Institute (MGI), generative AI could boost the global banking sector's annual revenues by $200 billion to $340 billion, or 2.8 to 4.7 percent, primarily by enhancing productivity.

Participants will gain insights on how Generative AI is transforming the finance industry and be equipped with the relevant knowledge and skills to evaluate and use Generative AI-powered tools and technologies in their organisations.

A short message from the Instructors.

Learning Objectives

By the end of the programme, you will be able to:

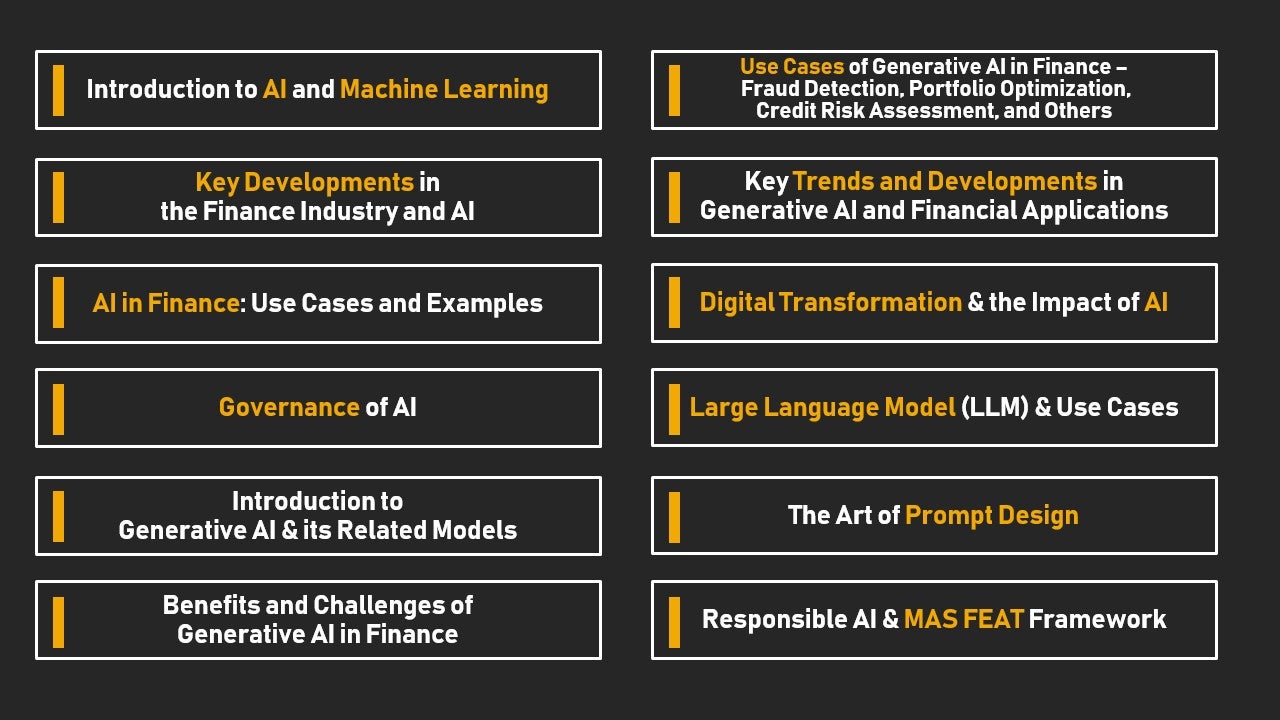

- Understand the fundamentals of AI, including machine learning, deep learning, natural language processing, and computer vision.

- Learn about the benefits and challenges of using Generative AI in finance, including fraud detection, risk management, and investment analysis.

- Explore how Generative AI is transforming the finance industry, including the rise of robo-advisors, chatbots, and other AI-powered tools.

- Examine key trends and developments in Generative AI and financial applications, including big data, centralised and decentralised storage, and the Internet of Things.

- Analyse real-world use cases of Generative AI in finance presented by bankers and policy makers, as well as discuss the challenges and future directions of Generative AI in finance, including the impact of new advancements in the field and potential risks associated with its widespread adoption.

- Find out more on ethical and regulatory issues related to Generative AI in finance, including bias, privacy, and security as well as compliance, ethics, and governance.

Programme Format

Online (Asynchronous)

Exclusive 1 hour live virtual classroom session with Prof Huang Ke-Wei